Tap‑to‑pay has been marketed as the future of checkout: fast, clean, modern. But behind the convenience is a quiet truth the payments industry rarely volunteers:

Tap‑to‑pay often costs merchants more than inserting the card, and in most cases, you are not contractually required to offer it.

Visa and Mastercard do not mandate that retailers accept contactless. They mandate acceptance of valid cards. You don’t have to take every possible method of presenting them. That distinction matters.

If a payment method increases your processing costs and isn’t required by your agreements, the logical move is simple:

Turn it off.

—

The Hidden Cost of “Convenience”

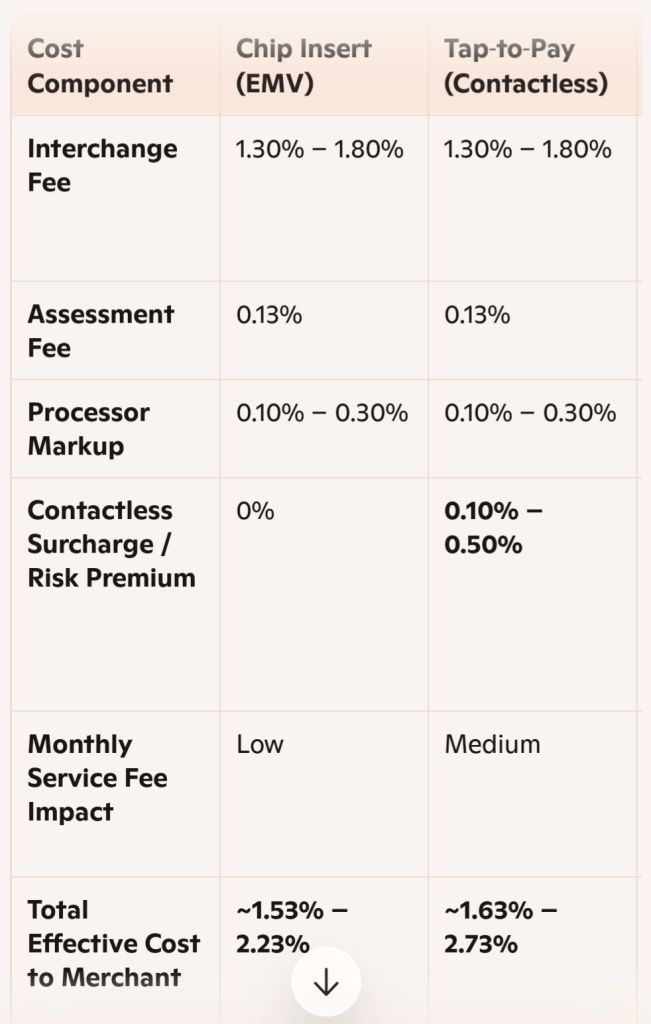

Interchange fees are the base fees set by Visa and Mastercard. They are identical whether a customer taps or inserts. But processors don’t price them the same.

Here’s what actually happens:

– Processors add contactless surcharges

– They apply higher risk premiums because the card is never physically handed over

– Some charge NFC enablement fees

– Others bundle tap into higher-tier pricing structures

None of this is visible to the customer.

All of it hits the merchant.

The result is predictable:

Tap‑to‑pay is typically 0.10%–0.50% more expensive than insert.

What This Means for the Average U.S. Retailer

The average brick‑and‑mortar retailer does about $5.5 million per year in sales.

Apply the tap premium:

– 0.10% premium → $5,500 lost annually

– 0.50% premium → $27,500 lost annually

That’s not a rounding error.

That’s a full payroll line.

That’s a store refresh.

That’s the difference between a 3% margin and a 2.5% margin.

And it’s entirely optional.

—

Does Turning Off Tap Violate Visa or Mastercard Rules?

No — not in the vast majority of cases.

Card‑brand rules require:

– Acceptance of valid cards

– Non‑discrimination between card brands

– Compliance with EMV standards

They do not require:

– NFC

– Contactless

– Tap‑to‑pay acceptance

– Every possible card‑present method

If you accept the card via chip, you are compliant.

This is the part processors don’t highlight, because tap‑to‑pay is more profitable for them than for you.

—

The Operational Case for Eliminating Tap‑to‑Pay

If a payment method:

– Costs more

– Isn’t required

– Adds no margin

– And shifts risk onto the merchant

…then the operationally rational move is to eliminate it.

Retail is a game of basis points.

If you can reclaim 10–50 of them by flipping a setting in your POS, that’s not a small decision, that’s strategy.

—

The Bottom Line

Tap‑to‑pay is convenient for customers and profitable for processors.

But for merchants, it’s often an unnecessary margin leak.

If your agreements don’t require it, and most don’t, you have every right to turn it off.

Insert the card. Protect the margin. Control the economics.

—